MP GST Registration In Bhopal

The GST is the product of one of the most significant tax reforms in the country which has improved the ease of doing business and broadened the taxpayer base. Madhya Pradesh’s GST registration included thousands of small businesses under one unified tax system. The introduction of GST in Madhya Pradesh has significantly reduced tax complexity. Indeed, several tax regimes are being abolished and incorporated into a single GST tax regime. You can also register GST with Webdoid Technologies, Contact Us Immediately to register GST.

Who do I need to get GST registration in Madhya Pradesh?

Businesses are required to register for GST in Madhya Pradesh if they belong to any of the categories mentioned below.

Gross Turnover: Service providers providing services above Rs.20 lakh per annum are required to register for GST in Madhya Pradesh. Legal persons engaged in the supply of goods must exceed Rs.40 lakh for mandatory GST registration in Madhya Pradesh.

Interstate Company: If a company supplies goods from one state to another, it must be registered for GST in Madhya Pradesh.

E-commerce : Persons who engage in the supply of goods and services through e-commerce platforms are required to register for GST in Madhya Pradesh irrespective of their income figure business. To start an e-commerce business, you must first be registered for GST. Occasional Taxpayers: Persons who supply seasonal goods or services through temporary stalls or shops are required to register for GST in Madhya Pradesh. Regardless of turnover, individuals must apply for GST registration.

Voluntary registration: A legal entity can voluntarily obtain the GST registration before the time a legal entity with the voluntary GST registration cannot waive its GST registration for up to one year. After the recent review, applicants can opt-out of their voluntary GST registration at any time.

The GST registration certificate provided by Madhya Pradesh has no validity period. It does not expire until canceled. GST registrations for general taxpayers and non-resident taxpayers are temporary registrations with an expiration date.

A PAN card is required to obtain GST registration in Madhya Pradesh. A PAN is required to obtain GST registration for an alien, property, partnership, LLP, corporation, or trust. If the PAN does not exist, the PAN is acquired first. However, the PAN is not required for foreigners and foreign companies. Speak to an expert today to get your GST registration in Madhya Pradesh.

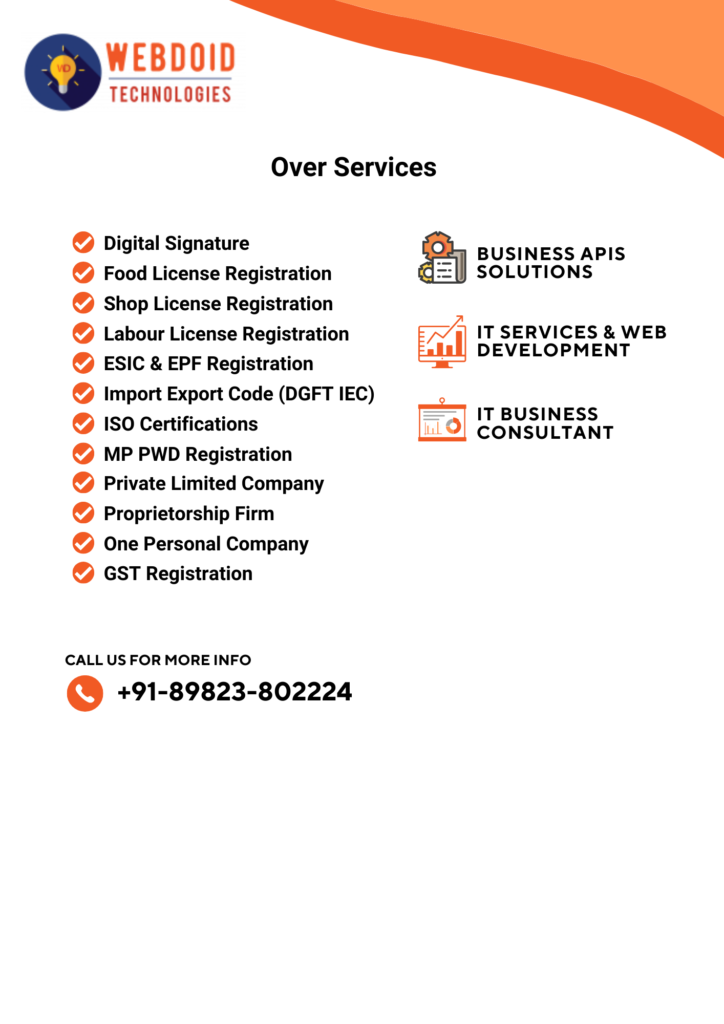

At Weboid Technologies, we provide complete solutions regarding GST Registration. We are Bhopal based legal consultancy company which are providing legal services including MP PWD Registration, Company Registration, Trademark Registration, Digital Signature etc.